The saga of Illumina/Grail has written its next chapter: Yesterday, the European Commission ordered Illumina to divest Grail and restore the situation prior to the acquisition. This post takes a look at the prerequisites for such an order and its implications.

As a quick reminder, in September 2020, US biotechnology company Illumina agreed to acquire US healthcare company Grail for approx. USD 8 billion. The European Commission blocked the deal two years later. The case also featured on this blog previously, both when the EU’s General Court ruled that the Commission may review transactions that are not notifiable anywhere in the EU (here) and when the Commission hit Illumina and Grail with a record fine for gun jumping (here).

So, while appeal proceedings are still ongoing, one can already say that the (envisaged…) transaction made antitrust history. Yesterday’s decision adds to that: The Commission wants Illumina to divest Grail, following three principles in the process:

- Grail must gain independence from Illumina to the same level Grail had prior to the transaction. In this respect, note that Illumina already held approx. 12% of Grail’s shares prior to the transaction.

- Post-divestment, Grail must be “as viable and competitive” as prior to the transaction.

- The divestment “must be executable within strict deadlines and with sufficient certainty”. The deadline seems to be 12 months, plus a potential of three month-extension.

The former Grail shareholders do not need to worry hope that they have to take Grail back: While the divestment plan has to be approved by the Commission, it is up to Illumina to decide how and to whom to divest Grail. Until the process is completed, lllumina and Grail have to remain separate.

Legal basis

The legal basis for such a far-reaching order is Art. 8(4) of the EU Merger Regulation. This provision is ultimately meant to protect the suspension obligation in the EU’s merger control regime, which requires parties to wait with closing their M&A deals until they have been cleared by the Commission (provided they have to be notified to reviewed by the Commission).

Prerequisites for and scope of a divestment order

Divestment orders are very rare, but not entirely unseen. They are, of course, subject to certain prerequisites and a certain scope:

- Naturally, a transaction has to have been consummated.

- It also has to have been prohibited, or consummated in breach of a condition that was a prerequisite for clearance (if the transaction was only cleared subject to remedies). I.e., a divestment order is generally not possible where a transaction would have to be cleared unconditionally.

- Under these circumstances, the Commission may require the parties to dissolve the transaction, ensuring that the situation prevailing prior to the transaction is restored.

- In addition, the Commission may order “any other appropriate measure” to ensure that the transaction is dissolved.

A divestment order has certain limits: The Commission may generally not require the divestment of shares held by the acquirer pre-transaction. And, it is unclear whether the Commission may indeed force acquirers to sell more shares than would be required for them to lose control of the target:

While the wording of Art. 8(4) EU Merger Regulation mentions the disposal of “all the shares” that have been acquired, some argue that such an order can generally not be proportionate, because the EU merger control regime only covers acquisitions of control. So, where an acquirer loses control and only keeps a non-controlling minority shareholding, the EU’s regime would arguably not apply. However, the “acquisition” of the minority shareholding via a divestment could then trigger merger control reviews in EU Member States whose merger control regime also apply to minority acquisitions (as in, e.g., Germany).

What is next

Since Illumina seems to have appealed every major Commission decision in this case, another appeal would not be entirely unsurprising. But leaving that aside, also given the history between the Commission and the parties, the regulator might take a strict stance during the divestment process, including regarding what might be a suitable divestment approach and, if Grail is sold to another acquirer rather than listed on a stock exchange, who would be a suitable buyer. It will be worth continuing to keep an eye on the case.

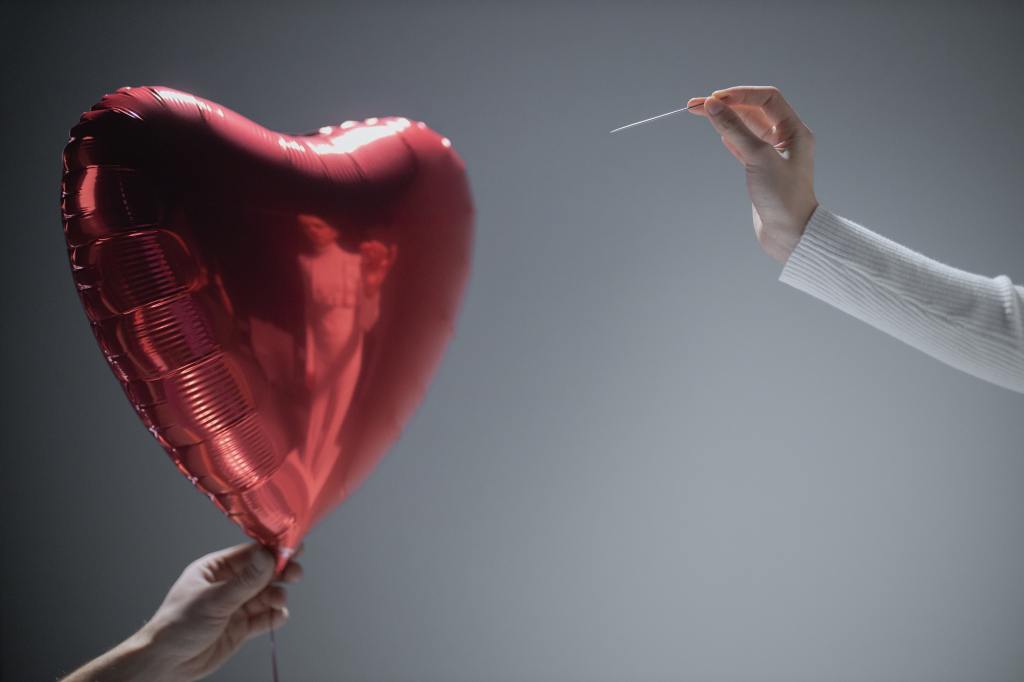

Photo by cottonbro studio